Africa Fintech Growth

Africa fintech growth is reshaping economies through mobile money, digital lending, and innovative payment platforms. With rising smartphone use and expanding financial access, fintech is unlocking new opportunities for businesses, entrepreneurs, and investors across the continent.

How Digital Finance Is Driving Economic Transformation

Africa’s financial technology sector is one of the fastest-growing industries on the continent. From mobile money and digital payments to AI-powered credit and stablecoin adoption, fintech is reshaping how people access financial services especially for the unbanked and underserved. Across major markets like Nigeria, Kenya, Egypt, and South Africa, fintech innovation is moving at pace and scale.

Explosive Market Growth & Revenue Potential

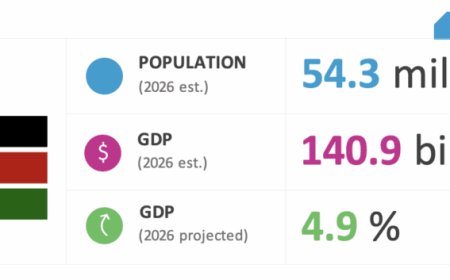

Africa’s fintech sector has expanded rapidly over the last decade. According to McKinsey & Company, the continent’s financial services revenues could grow at around 10 % annually through 2028, with fintech as a key driver underpinning this trend.

Investment analysts project that fintech revenues in Africa could reach around $47 billion by 2028, representing nearly a five-fold increase from earlier valuations. Long-term forecasts even suggest the possibility of reaching $65 billion by 2030 with sustained growth and product diversification.

This projected growth is built on several structural advantages:

-

Rapid digital adoption

-

Mobile penetration and smartphone growth

-

Young populations eager to adopt financial solutions

-

Large underserved markets with high unmet demand

Mobile Money: The Foundation of African Fintech

Mobile money remains the foundation of fintech growth in Africa. Originating with M-Pesa in Kenya in 2007, mobile wallets have become synonymous with financial inclusion across the continent. M-Pesa itself has onboarded tens of millions of users, enabling deposits, transfers, bill payments, and credit services through mobile phones.

Mobile money’s success stems from partnering with existing agent networks, small shops, and local merchants bringing banking services to people who previously lacked access to traditional financial institutions.

This mobile-first approach has bridged the gap for rural and unbanked populations and laid the groundwork for broader fintech services like micro-credit, savings platforms, and insurance products.

Innovations Beyond Payments

While payments and wallets were the original growth engines, African fintechs are now expanding into value-added financial services:

AI & Predictive Finance

Artificial intelligence is transforming underwriting, fraud detection, and credit scoring allowing fintech platforms to serve customers previously deemed “unbankable.” These systems analyze alternative data (like mobile usage or utility payments) to unlock credit for small business owners and individuals.

Embedded Finance & Lending

Fintech firms are embedding financial services into daily activities, enabling lending, insurance, and remittances within a single app ecosystem. Firms such as PalmPay in Nigeria now process millions of daily transactions and have even expanded into health insurance offerings illustrating how fintech is broadening its economic footprint.

Stablecoin & Blockchain

Emerging reports suggest that stablecoins digital assets pegged to fiat now account for a significant portion of crypto transactions in Sub-Saharan Africa, especially for remittances and cross-border payments, offering a cheaper alternative to traditional channels.

Regional Leaders & Ecosystem Development

Fintech isn’t evenly distributed across the continent; growth clusters are emerging:

-

Nigeria: A massive market with deep fintech activity, large funding rounds, and high levels of digital payment adoption.

-

Kenya: A global leader in mobile money and digital finance.

-

South Africa: A more mature financial market with advanced fintech infrastructure.

-

Egypt and Ghana: Rapidly growing ecosystems supported by regulatory reforms and increasing investment.

Even outside these hubs, interoperable platforms like Ghana’s GhIPSS and regional systems such as the Pan-African Payment and Settlement System (PAPSS) are improving cross-border liquidity and lowering transaction costs.

Challenges & Opportunities Ahead

Despite the progress, Africa’s fintech sector faces hurdles:

-

Regulatory fragmentation: Different countries have varying rules, complicating cross-border expansion.

-

Cybersecurity risks: Digital financial services attract cyber threats, prompting the need for stronger regulation and infrastructure.

-

Funding volatility: Fintech funding saw a dip before rebounding, underscoring the sector’s sensitivity to global capital flows.

Yet these challenges also create opportunities. Solutions that simplify compliance, strengthen data protection, and support interoperability are fertile ground for innovation.

The Economic Impact

Fintech’s impact goes beyond finance:

-

Financial inclusion: Millions of previously unbanked Africans now access digital wallets and credit.

-

Entrepreneurship support: Fintech lending platforms help small businesses secure working capital.

-

Cost reduction: Lower remittance and transaction costs increase disposable income.

In markets where traditional banking services struggled to scale, fintech has democratized access to financial tools supporting economic activity, entrepreneurship, and digital transformation.

Africa’s fintech growth is not a trend it’s a transformation. Built on mobile innovation, demographic advantage, and digital adoption, fintech platforms are reshaping how the continent engages with money, trade, and economic opportunity.

With projections pointing to exponential revenue growth and expanding financial inclusion, Africa’s fintech evolution is one of the most exciting stories in global finance and it’s far from over.

Whether you are an entrepreneur, investor, policymaker, or business leader, understanding these dynamics will help you seize opportunities in Africa’s digital finance revolution.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0